Equipment Management

Equipment Management guides UCI in properly tracking capital equipment - whether the university builds, buys, borrows, or receives it for free.

Frequently Asked Questions

Follow the steps in the Capital Asset training guide to complete a KFS General Error Correct (GEC).

PALCard Reconciler can create Capital Asset for KFS PCDO by following the instruction in the PALCard training guide .

- The State of California allows all research and development equipment a partial exemption from sales and use taxes. The effective tax rate is 3.8125% (subject to change, based on the current Orange County, CA sales and use taxes rate of 7.75% minus an exemption of 3.9375%) from January 1, 2017, to June 30, 2030.

- The CDTFA requires form CDTFA-230-M to be completed, attached to the Purchase Order (PO) and sent to the supplier.

- When a requisition is submitted with the equipment object code of 9000, Equipment Manager reviews the requisition and selects “yes” for the field of CA Partial Reduced Sales/Use Tax for Research & Development Equipment.

- Once the requisition is approved, KFS will generate a PO for the Central Procurement Buyer to review. The Central Procurement Buyer will complete the CDTFA-230-M form and attach the completed form to the PO and send to vendor.

- Accounts Payable will pay the reduced tax rate as indicated on the PO.

- This only applies to Research & Development Equipment that are greater than $5K.

The resale certification is used when the department purchases goods for resale purposes. For example, when the bookstore purchases books for resale, then the bookstore needs to attach the Resale Certification in KFS Requisition. For these specific line items, they would select “Non-taxable” for the goods.

Central Procurement Buyers will need to attach the Resale Certification to the PO and send to vendor.

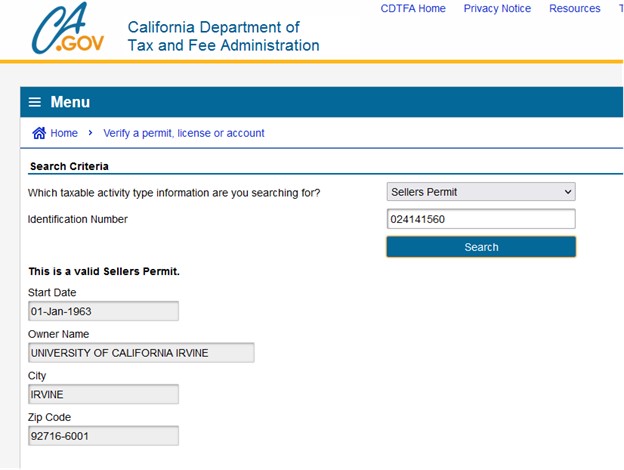

Seller’s Permit (The wholesalers and retailers must apply for a permit):

Follow the CAM Update Edit instructions in the Capital Asset training guide .

The University of California is not exempt from sales tax, if the Equipment title vests with Government, then the department’s Contracts & Grants Officer to provide the contract award document with “specified Equipment title vests with Government” terms & conditions to Equipment Manager for verification.

After the Equipment Manager verifies, the department needs to attach the contract award document to the Requisition and select “Non-taxable” in the appropriate line item.

Central Procurement Buyers will attach the contract awards document “specified Equipment title vests with Government” to the PO and send to vendor.

For more information, please visit Accounting & Fiscal Services Tax Compliance and Reporting page.

Exempt from indirect cost (budget in equipment category):

- Equipment over $5K, title remains with the university.

Not Exempt from indirect cost (budget in supplies category):

- Materials, supplies, & low-value equipment.

- Equipment where the title remains the awarding agency.

- Equipment loaned back to the awarding agency.

- Equipment shipped to the awarding agency.

Pending federal awards funding for equipment purchase:

- Must apply for “RAS” Request Advance Spending from the Sponsored Projects Administration (SPA).

- Must comply with federal funds purchase requirements.

- Cannot purchase equipment in advance with non-federal funds.

Search the keyword "Requisition" from the Capital Asset training guide .

Follow the instructions in the Capital Asset training guide :

Fill out the Surplus Pickup Request .

Need personalized assistance?