Procurement

Frequently Asked Questions (FAQs)

Please visit UCOP's internal site for instructions and FAQs .

Please search the list of commodity codes to find the most applicable code for your purchase. Select the following link to learn how to ready how commodity codes are categorized by segment and family: Commodity UNSPSC Family Codes . To search in KFS, please refer to the training guide . For additional assistance, contact Procurement Services.

Retail sales of tangible items in California are generally subject to sales tax.

Examples include furniture, giftware, toys, antiques and clothing. Some labor services and associated costs are subject to sales tax if they are involved in the creation or manufacturing of new tangible personal property.

Some items are exempt from sales and use tax, including:

- Sales of certain food products for human consumption.

- Sales to the U.S. Government.

- Sales of prescription medicine and certain medical devices.

- Sales of items paid for with EBT cards.

Some sales are also nontaxable because the seller and/or purchaser meet certain criteria. A complete list of nontaxable sales is available in Publication 61, Sales and Use Tax: Exemptions and Exclusions .

To learn more about the sales and use taxes administered by the California Department of Tax and Fee Administration, visit Sales and Use Tax in California.

Please visit California Franchise Tax Board for the latest governance on what is taxable.

- The State of California allows all research and development equipment a partial exemption from sales and use taxes. The effective tax rate is 3.8125% (subject to change, based on the current Orange County, CA sales and use taxes rate of 7.75% minus an exemption of 3.9375%) from January 1, 2017, to June 30, 2030.

- The CDTFA requires form CDTFA-230-M to be completed, attached to the Purchase Order (PO) and sent to the supplier.

- When a requisition is submitted with the equipment object code of 9000, Equipment Manager reviews the requisition and selects “yes” for the field of CA Partial Reduced Sales/Use Tax for Research & Development Equipment.

- Once the requisition is approved, KFS will generate a PO for the Central Procurement Buyer to review. The Central Procurement Buyer will complete the CDTFA-230-M form and attach the completed form to the PO and send to vendor.

- Accounts Payable will pay the reduced tax rate as indicated on the PO.

- This only applies to Research & Development Equipment that are greater than $5K.

The resale certification is used when the department purchases goods for resale purposes. For example, when the bookstore purchases books for resale, then the bookstore needs to attach the Resale Certification in KFS Requisition. For these specific line items, they would select “Non-taxable” for the goods.

Central Procurement Buyers will need to attach the Resale Certification to the PO and send to vendor.

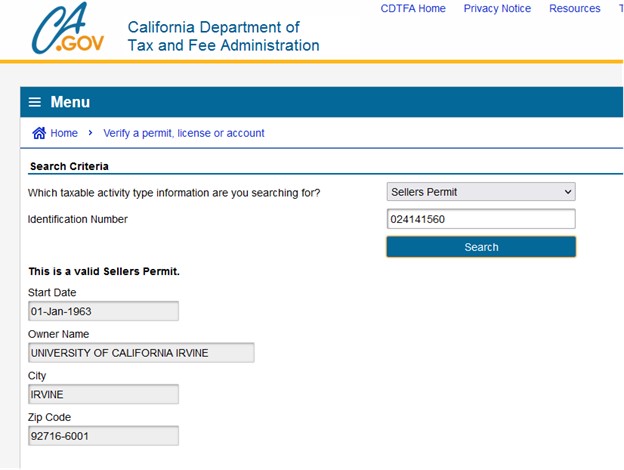

Seller’s Permit (The wholesalers and retailers must apply for a permit):

If the software is licensed and we are paying for a license (more common), then the software is NOT considered a capital asset. The object code for that is:

8034 - SOFTWARE NON-CAPITALIZED UNDER $5000

8036 - SOFTWARE NON-CAPITALIZED OVER $5000

However, if UCI purchasing proprietary software where we will own the software, it will be considered a capital asset. This is less common. Open a ServiceNow ticket -> Equipment Management -> Capital Assets Requisitions for more assistance.

The University of California is not a tax-exempt entity, if the Equipment title vests with Government, then the department’s Contracts & Grants Officer to provide the contract award document with “specified Equipment title vests with Government” terms & conditions to Equipment Manager for verification.

After the Equipment Manager verifies, the department needs to attach the contract award document to the Requisition and select “Non-taxable” in the appropriate line item.

Central Procurement Buyers will attach the contract awards document “specified Equipment title vests with Government” to the PO and send to vendor.

For more information, please visit Accounting & Fiscal Services Tax Compliance and Reporting.

When vendors are onboarded onto KFS (Kuali Financial System), a Certificate of Insurance is requested and managed through PaymentWorks.

Any employee who has been granted Role 32 User Access by their Departmental Security Administrator (DSA).

View Training Guide and Additional Resource for more information.

Fiscal Officer - Role is set by Account Number(s). Has the ability to change account information and add reference information in the ORG REF ID field. A Fiscal Officer cannot also be an Accounting Reviewer.

Content Reviewer - Has the ability to edit any field in the Requisition. Multiple Content Reviewers are allowed; however, the Requisition routes to everyone at the same time and the first person to take action, moves the document along in workflow. The Fiscal Officer and Content Reviewer can be the same person, and the Requisition routes only once to the individual.

Accounting Reviewer - Role is set by Organization Code. Role received FYI or Acknowledgment notifications only. Document does not need approval from this role. Accounting Reviewer cannot also be a Fiscal Officer. Select the following link to view a workflow diagram: Requisition and Purchase Order Workflow .

An approved Requisition converts to an unapproved Purchase Order, which routes to a Departmental Buyer (≤$5,000 and non-restricted commodity) or a Central Procurement Contract Manager (buyer) (>$5,000 or restricted commodity). Orders initiated in UCIBuy that qualify as an Automatic Purchase Order (APO), bypass the Departmental Buyer and are automatically transmitted to the vendor. View UCIBuy section for more information.

There are two options to change your primary Organization Code.

- Have the department Departmental Security Administrator (DSA) email kfs@uci.edu to request changing your primary Organization Code to the desired code (as in the case of split appointments or temporary employees).

- Have the Departmental Security Administrator (DSA) verify that 54 is entered in the Role Name Lookup field and KFS-PURAP-Purchasing/Accounts Payable is selected in the Namespace Code field for the correct Organization Code.

There are several purchasing methods available at UCI based on commodity. Select the following link to view a list of commodities and their respective purchasing method(s): Purchasing Methods Guide.

A KFS Payment Decision Tree may also be a useful tool to help for reference.

Select the following links for step-by-step instructions:

eCourse are also offered; visit the UC Learning Center more information.

Email the missing building name and/or room number(s) to procurement@uci.edu. For buildings with no room number, enter "NOROOM."

Double-check your search parameters. If the vendor still cannot be located, check to see if they are in the process of being onboarded. If the vendor is not in the onboarding process, submit a Vendor Onboarding request. Select the following link to view the Kuali Vendor Onboarding (KVO) System Web Guide or email kfs@uci.edu for assistance.

The initiator attaches backup documentation in the Notes and Attachments tab of the Requisition, be sure to indicate that there is attachment in the Explanation field. For details, review the Requisition Training Guide .

Note: It is the Contract Manager's (Department buyer) responsibility to attach backup documentation from the Requisition to the Purchase Order's Notes and Attachments tab.

Detailed instructions are available in the Requisition Training Guide . Only Contract Managers (department buyers) are allowed to give Purchase Order numbers to vendors.

The name of the Contract Manager (Procurement Services or Department buyer) is located in the Document Overview tab of the Purchase Order.

Select the following link to view the Transfer and Assist a Purchase Order Training Guide .

Contract Managers are responsible for determining one of the three transmission methods prior to approving a PO:

- Manual (non-auto fax/email): Contract Manager emails the PO and any associated documents to the Vendor.

Note: Contract Managers cannot change the transmission method for standard requisitions to a supplier that is in UCIBuy. In this case, the transmission method will default to Manual (non-auto fax/email). Contract Manager is responsible for physically completing the task of faxing or emailing the PO and any associated documents to the Vendor. - Auto Fax: Contract Manager is responsible for validating the correct fax number. System automatically faxes approved PO.

- Auto Email: Contract Manager is responsible for validating the correct email address. System automatically emails approved PO.

Instructions are available in the Purchase Order Training Guide . Only Contract Managers are allowed to give Purchase Order numbers to the vendors.

Fiscal Officers receive an FYI for orders ≤$15,000, or an Approve for orders >$15,000 in their Action List. Select the following link to view the Locating Payment Information for Purchasing Transactions instructions.

Note: If you receive an invoice from the vendor, please forward to Accounts Payable at accounts-payable@uci.edu to ensure payment. Email is the preferred option, but you may also send a hard copy of the invoice through intercampus mail to ZOTCode 1050 or fax it to 949-824-2098.

Review the Purchase Order Amendment training guide . or additional assistance, contact Procurement Services.

Select the following link for step-by-step instructions to Void or Close a Purchase Order .

Purchases over $100,000 must either be competitively bid or support a sole source justification, unless your purchase is using a UCOP or UCI Agreement vendor that is NOT on a Price Schedule. Awards for purchases over $100,000 must be based upon either lowest cost or Best Value Method. See the Competitive Bidding Process for further details.

For soft surfaces (carpet), hard casters are needed. For hard surfaces (linoleum or hard plastic chair mats) soft casters are needed. Selecting the appropriate caster will insure the chairs will roll easily and not damage or mar linoleum floors.

Search the UCIBuy punch-out catalog. If you need more furniture than what is available there, or you are unsure of what you need, contact the approved contracted suppliers, and we will help get you started.

The lead time for most furniture is 4-6 weeks, and depending on the size of the project, it may take 2+ weeks to finalize your design. Because of the longer lead times, start the process early, especially if furniture is needed for the arrival of new staff/faculty.

The primary system-wide agreement with Steelcase (Tangram is the distributor) should be considered first. Other contracted manufacturers include additional options for height adjustable workstations, ergonomic chairs, stools, and computer accessories can be procured by Blue Space.

We maintain a showroom of the most commonly purchased chairs, stools, and height adjustable workstations. These items can be tried in the Environmental Health & Safety (EHS) showroom, or you can rent most Steelcase task chairs on a monthly basis. Additionally, our Steelcase dealer, Tangram, has a showroom in Newport.

This is generally true and can be purchased at Peter's Exchange. Used furniture is often much less, but typically do not include a product warranty.

Visit How to Buy Surplus Property for instructions on surplus sales.

Make sure you understand what type(s) of software or IT services you need (quantity, licenses, compatibility with other equipment, etc.). Visit Buying Software/IT Services for more information.

The following message is triggered in KFS based on the account type and the amount:

Federal Grants and Cooperative Agreements $10K and above.

Federal Contracts $35K and above.

Federal Grants and Cooperative Agreements $100K and above.

Federal Contracts $150K and above.

Federal awards funds that “flow-through” from another institution (i.e. state, university, etc.) to UC. Transactions funded by such awards are subject to federal requirements.

Yes, the same requirements apply for all purchases. There is a hard block on purchases over $10K on PALCard for any Federal Purchases.

Yes, debarment and anti-lobby verification need to be performed even if the purchase is from a contracted supplier (UCOP or local).

Yes, debarment and anti-lobby verification need to be performed for purchases with mixed funds if the total purchase amount is over $10,000, irrespective of the Federal Fund dollar amount.